Framework Homeownership Making an Offer Answers refers to a standardized set of data points, decision logic, and educational responses used within the Framework homeownership platform to guide buyers through submitting a purchase proposal. This methodology ensures that offer prices, contingencies, and timelines are legally sound, financially realistic, and data-consistent.

The Strategic Importance of the Offer Framework

Making an offer is the most high-stakes moment in the home-buying journey. It is the transition point from “searching” to “contracting,” where a single mistake in a contingency or a miscalculation in price can lead to financial loss or a rejected bid.

Within the Framework Homeownership ecosystem, “Making an Offer Answers” provides a structured pathway. For buyers, it demystifies the legal jargon; for developers and platforms, it creates a “schema” for real estate transactions that reduces friction and supports automated validation.

Why Structure Matters in Real Estate Offers

Most first-time buyers are overwhelmed by the complexity of a purchase agreement. By using a standardized framework of “Answers,” the process moves from a chaotic series of guesses to a logical sequence of validated steps.

-

Clarity: Eliminates ambiguity in earnest money and closing dates.

-

Compliance: Ensures all state-specific disclosures and legal requirements are met.

-

Speed: In a competitive “Seller’s Market,” the ability to generate a clean, validated offer in minutes is a distinct advantage.

Read Also: Avulsion Real Estate Explained: Sudden Land Changes

Core Components: The “Answers” That Win Deals

When we look at the Framework Homeownership Making an Offer Answers, we are essentially looking at a decision matrix. Each “answer” provided by the buyer must satisfy three criteria: it must be affordable, it must be competitive, and it must be legally protected.

1. Determining the Offer Price

The framework doesn’t just ask “What do you want to pay?” It guides the user through a comparative analysis.

-

Market Data: Utilizing “Comps” (comparable sales) from the last 3–6 months.

-

Buyer Constraints: Cross-referencing the offer with the user’s mortgage pre-approval limit.

-

Appraisal Gap Logic: Determining if the buyer has the cash to cover the difference if the bank values the home lower than the offer price.

2. Strategic Contingencies

Contingencies are “escape hatches.” The framework provides structured answers for which ones to include based on risk tolerance:

-

Financing Contingency: Protects the buyer if the loan falls through.

-

Inspection Contingency: Allows for negotiation or withdrawal if structural issues are found.

-

Appraisal Contingency: Ensures the buyer isn’t forced to overpay for a property the lender won’t fully back.

3. The Timeline and Earnest Money

The “Answers” here define the “skin in the game.”

-

Earnest Money Deposit (EMD): Usually 1% to 3% of the purchase price, showing the seller you are serious.

-

Closing Date: Aligning the “Answer” with the lender’s ability to fund (typically 30–45 days).

Comparison: Traditional vs. Framework-Based Offers

Step-by-Step: How the Offer Logic Works

If you are a developer building a homeownership platform or a buyer using one, the workflow for Framework Homeownership Making an Offer Answers follows a predictable, highly effective path:

Step 1: Financial Validation

Before an offer answer can be generated, the system checks the Mortgage Pre-approval. If a buyer attempts to offer $500,000 but is only cleared for $450,000, the framework triggers a “Hard Stop” or a “Validation Warning.”

Step 2: Competitive Market Analysis (CMA)

The buyer answers questions about the property’s condition compared to others in the area. This helps the framework suggest a “Winning Range”—a price bracket that is likely to be accepted without overpaying.

Step 3: Contingency Selection

The framework presents a “Menu of Protections.” In a “Hot Market,” the framework might suggest a “Shortened Inspection Period” rather than a total waiver, balancing competitiveness with safety.

Step 4: Submission and Negotiation Logic

Once the offer is submitted, the “Answers” continue to evolve. If a seller issues a counteroffer, the framework evaluates the new terms against the buyer’s original “Safe Zones” and provides a recommendation to Accept, Counter, or Walk Away.

Read Also: How to Attract International Real Estate Buyers in 2026

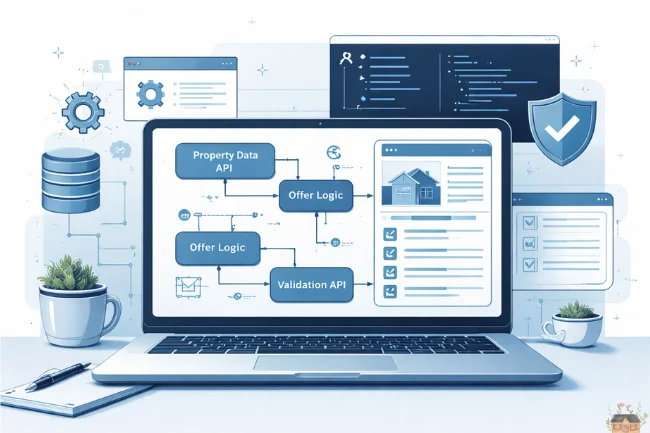

Technical Insights for Product Teams

For those building or maintaining these systems, the Framework Homeownership Making an Offer Answers serves as a reference model for API design and user interface (UI) flow.

Implementing Validation Rules

To ensure the integrity of the offer, developers should enforce the following rules within their code:

-

Date Logic: Closing dates cannot be in the past or on federal holidays (when banks are closed).

-

Range Checks: Offer prices must be within a predefined percentage of the listing price (unless manually overridden by a licensed agent).

-

Dependency Mapping: If a “Cash Offer” is selected, the “Financing Contingency” should be automatically disabled.

Expert Insight: “The most robust homeownership platforms use Deterministic Logic (fixed rules) for the legal components of an offer and Probabilistic AI (predictive models) for the pricing strategy. This hybrid approach ensures the offer is legally valid while remaining strategically competitive.”

Common Challenges and How to Solve Them

Even with a structured framework, the “Human Element” of real estate can introduce variables.

-

The Emotional Overbid: Buyers often want to ignore the “Answers” provided by the framework when they fall in love with a home.

-

Solution: Use “Friction Points”—pop-ups that require the buyer to acknowledge the financial risk of exceeding their pre-set limits.

-

-

Multiple Offer Scenarios: When there are 10 offers on one house, standard logic may seem insufficient.

-

Solution: Implement Escalation Clause Logic, where the “Answer” includes a rule to automatically increase the bid by a set amount (e.g., $2,000) above the highest competing offer, up to a maximum cap.

-

Commonly Asked Questions about Home Offers

1. What exactly are “Making an Offer Answers”?

They are the specific, structured data points (price, dates, contingencies) that form a complete real estate proposal within the Framework Homeownership education and transaction system.

2. How does this framework help first-time buyers?

It reduces “Cognitive Overload” by breaking a 20-page legal document into simple, understandable questions with guided recommendations.

3. Is the framework legally binding?

The framework itself is a guidance tool. However, once the “Answers” are populated into a state-approved Purchase Agreement and signed by both parties, it becomes a legally binding contract.

4. Can I change my answers after submitting an offer?

Once submitted, you cannot unilaterally change an offer. You must wait for the seller to “Reject” or “Counter,” at which point you can provide new “Answers” in your response.

5. How does the framework handle “All-Cash” offers?

The logic simplifies significantly. It removes the need for mortgage-related questions, appraisal contingencies, and lender-mandated timelines, often allowing for a much faster “Closing Date Answer.”

6. What is the correct way to make an offer on a home?

The correct way is to submit a formal, written purchase agreement through your agent that specifies your proposed price, earnest money, closing timeline, and essential contingencies. This ensures all terms are legally documented.

7. What’s the biggest reason to make your offer contingent on a professional home inspection?

It provides a vital legal “escape hatch” that allows you to renegotiate or withdraw without losing your deposit if costly structural or safety issues are discovered.

8. What happens when a buyer makes an offer?

Once submitted, the seller can accept, reject, or issue a counteroffer. The home remains “active” on the market until a “meeting of the minds” is reached and the contract is signed.

9. When making an offer on a home, it is customary for the buyer to give __________ with the purchase and sales agreement in order to show good faith?

It is customary for the buyer to give earnest money (also known as a good faith deposit). This sum is held in escrow to show the seller you are financially committed to the transaction.

Conclusion: Building a Better Path to Homeownership

The Framework Homeownership Making an Offer Answers methodology is about more than just filling out a form; it is about empowering buyers with the same level of data and logic that professional investors use. By standardizing the “how” and “why” behind every offer, we create a real estate market that is more transparent, efficient, and accessible.

Whether you are a buyer looking for clarity or a developer aiming to build the next generation of real estate tech, focusing on structured, validated offer answers is the key to success.

Learn about BRBC Real Estate

For broader information, visit Wellbeing Makeover

I’m Salman Khayam, the founder and editor of this blog, with 10 years of professional experience in Architecture, Interior Design, Home Improvement, and Real Estate. I provide expert advice and practical tips on a wide range of topics, including Solar Panel installation, Garage Solutions, Moving tips, as well as Cleaning and Pest Control, helping you create functional, stylish, and sustainable spaces that enhance your daily life.